Protect Your Home and Possessions With Comprehensive Home Insurance Policy Protection

Recognizing Home Insurance Policy Protection

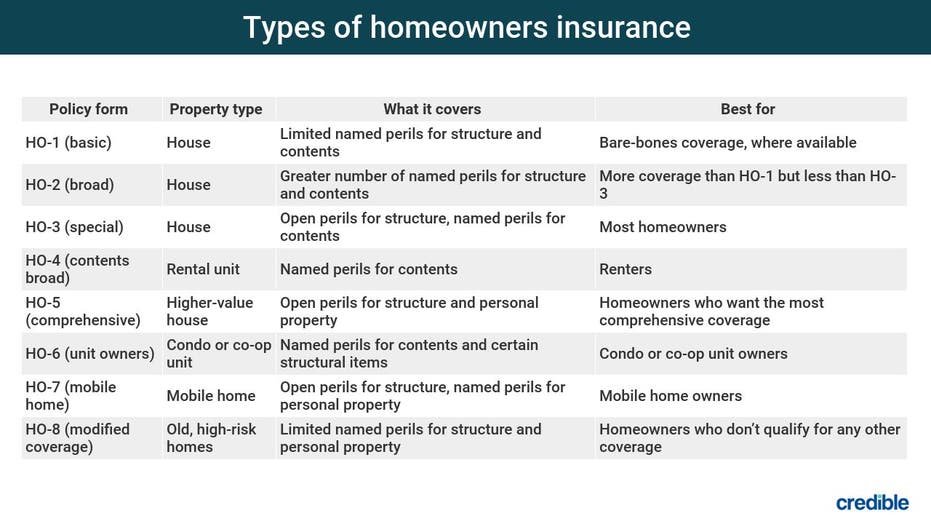

Comprehending Home Insurance coverage Protection is important for property owners to safeguard their residential or commercial property and properties in instance of unpredicted occasions. Home insurance coverage generally covers damage to the physical framework of the residence, personal possessions, responsibility defense, and extra living expenditures in case of a protected loss - San Diego Home Insurance. It is essential for property owners to realize the specifics of their plan, including what is covered and excluded, plan limitations, deductibles, and any type of added recommendations or riders that might be needed based on their specific situations

One secret aspect of recognizing home insurance coverage is recognizing the difference between actual money value (ACV) and substitute expense protection. ACV takes depreciation right into account when repaying for a covered loss, while substitute expense coverage compensates the complete expense of replacing or fixing the harmed building without considering depreciation. This distinction can considerably influence the quantity of repayment gotten in case of a case. Home owners need to additionally recognize any type of protection limitations, such as for high-value products like jewelry or artwork, and take into consideration acquiring additional insurance coverage if essential. Being well-informed concerning home insurance coverage makes sure that homeowners can appropriately safeguard their investments and properties.

Benefits of Comprehensive Policies

When discovering home insurance policy protection, house owners can gain a much deeper recognition for the protection and peace of mind that comes with thorough policies. Comprehensive home insurance coverage plans provide a wide array of benefits that go beyond standard insurance coverage.

In addition, extensive plans often include protection for liability, using defense in situation a person is hurt on the home and holds the homeowner accountable. This responsibility coverage can aid cover legal costs and clinical costs, supplying additional tranquility of mind for house owners. Moreover, thorough policies may likewise use added living expenses protection, which can aid pay for momentary real estate and other required expenses if the home ends up being unliveable as a result of a covered event. On the whole, the thorough nature of these plans supplies home owners with durable defense you could try these out and monetary protection in numerous scenarios, making them an important investment for protecting one's home and properties.

Customizing Coverage to Your Requirements

Tailoring your home insurance policy coverage to line up with your specific needs and situations makes certain a effective and customized guarding technique for your home and assets. Tailoring your insurance coverage enables you to deal with the unique facets of your home and belongings, offering an extra extensive guard against prospective risks. Inevitably, personalizing your home insurance policy coverage provides tranquility of mind knowing that your properties are guarded according to your distinct situation.

Securing High-Value Possessions

To adequately safeguard high-value possessions within your home, it is necessary to analyze their worth and consider specialized protection options that deal with their one-of-a-kind value and significance. High-value assets such as art, fashion jewelry, vintages, and collectibles may exceed the coverage restrictions of a common home insurance plan. Consequently, it is crucial to work with your insurance company to ensure these things are sufficiently secured.

One method to secure high-value possessions is by setting up a separate plan or endorsement particularly for these things. This customized coverage can give greater protection restrictions and may also consist of extra defenses such as insurance coverage for unintentional damage or strange disappearance.

Additionally, prior to getting protection for high-value assets, it is advisable to have these items properly assessed to establish their existing market price. This assessment paperwork can help streamline the claims procedure in the occasion of a loss and guarantee that you get the proper compensation to change or repair your useful properties. By taking these positive actions, you can delight in tranquility of mind knowing that your high-value possessions are well-protected versus unforeseen circumstances.

Claims Refine and Plan Monitoring

Verdict

In verdict, it is crucial to guarantee your home and possessions are properly shielded with thorough home insurance coverage. It is critical to prioritize the protection of your home and possessions via comprehensive insurance coverage.

One trick aspect of recognizing home insurance protection is knowing the difference in between real money value (ACV) and replacement expense insurance coverage. Property owners ought to likewise be conscious of any type of insurance coverage restrictions, such as for high-value things like jewelry or artwork, and take into consideration acquiring additional protection if essential.When discovering home insurance coverage, house owners can get a deeper gratitude for the protection and tranquility of mind that comes with comprehensive policies. High-value properties such as great art, jewelry, antiques, and antiques might exceed the coverage limitations of a conventional home insurance coverage policy.In final thought, it is crucial to ensure your home and assets are appropriately shielded with comprehensive home insurance coverage.